As technology advances and connects the globe, it brings along internet scams that outsmart individuals daily. Criminals online are changing their methods on a daily basis to trap their targets through various emails, social media platforms, online shopping sites, and even gambling websites. One of the necessary skills that everyone needs to develop in this digital era is knowing the various types of internet scams, their indicators, and how to avoid them, which in turn helps maintain one’s online safety along with personal and financial data.

Phishing

Phishing, is where the scammer will use emails or messages that mask themselves as trustworthy sources, be it reputable companies, government agencies, or even banks so that the target willingly exposes vital information like login details, credit card numbers, or citizenship details to mention a few.

Investment Scams

There is always a classic investment scam on hand, offering a huge return on investment with little to no risk involved. These scams can appear in the form of Ponzi schemes, cryptocurrency scams, or fake stock trading websites. Scammers tend to manipulate victims into depositing funds that are rapidly withdrawn by the scammers.

Tech Support Scams

Tech support scams are a common form of scam where criminals pose as workers of a tech company be it an IT support company or a computer manufacturing company. They tell you that your device or computer has a breach or is infected with a virus and then request payment in return for a non-existent solution. Sometimes they will go one step further and ask you to give them access to your computer which they use to access your bank accounts and transfer the funds to themselves.

How to Identify Internet Scams

Suspicious Communication

Any unexpected attempts to contact you should always be treated with caution and investigated carefully. Fraudulent messages can often create confusion or panic by spreading misinformation. Typically, these fake communications include noticeable errors, such as spelling mistakes, poor grammar, or unusual phrases that do not make sense. The rule of thumb for many is not to answer a call if it is from an unknown number.

Requests for Personal Information

Many organisations are at risk of having their systems hacked at any given moment. Remain suspicious against attempts in emails, messages or phone calls that target sensitive data like passwords, banking details, or identity-claiming verification.

Offers that are Too Good to be True

If you find an offer online that seems too good to be true, unfortunately, it probably is. Unsuspecting individuals may be tricked into giving over details, which makes it very important to think rationally about any deal you may see so as to not fall for these traps.

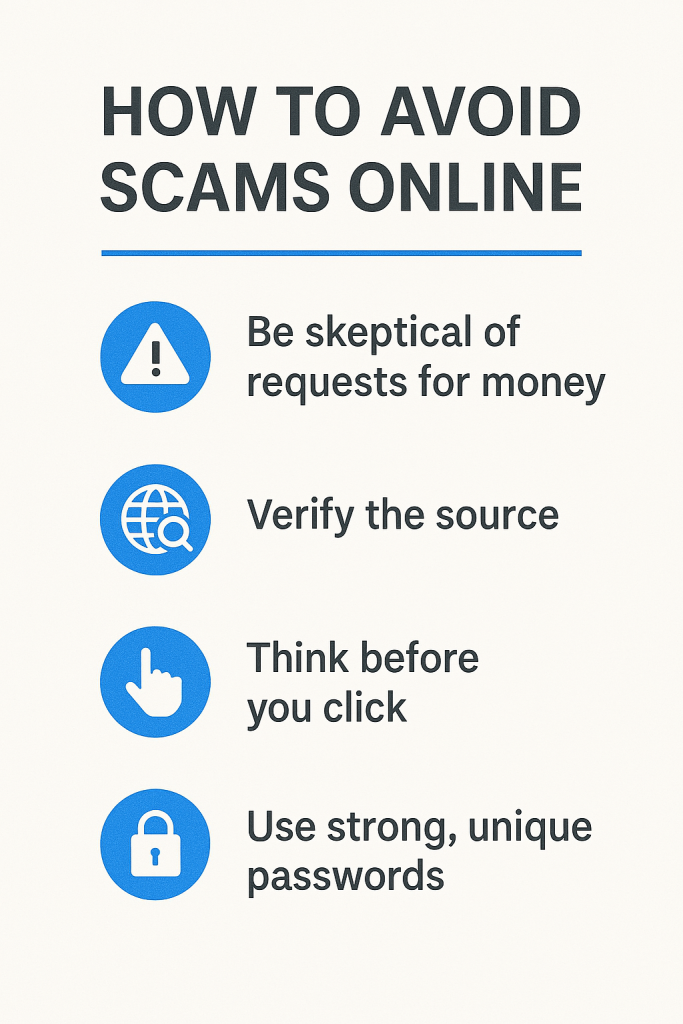

Avoiding Internet Scams

Stay Informed and Educated

The best way to avoid scams is by keeping yourself educated about new ones. For example, cybersecurity recommendations provided at agile.org.uk can help you understand how to use the internet safely and defend yourself against online threats.

Use Reliable Security Software

Using reliable software that offers real-time protection from malware, phishing, and other dangers increases your safety. In addition to this, regularly updating and scanning your software increases protection from all online threats.

Verify the Authenticity of Websites

Before giving out your personal information or making any purchases, check if the website is authentic by ensuring that there is a secured connection with HTTPS and a lock symbol. Also, check other independent reviews for further confirmation. A good reputation guarantees that the website is not a scam.

Secure Payment Methods

Whenever possible, use secure and traceable payment methods as this helps to protect you against loss. Payment services that grant buyer protection or trusted third parties increase the safety of your money.

Secure Payment Methods at Online Casinos

Players like to use Trustly, because it offers a direct bank transfer option, deposits are instant, and withdrawals, are done in a few seconds without risking sensitive banking details. For example, websites like https://www.newcasinos.com/money-transfer/trustly/ state that Trustly is unarguably the most effective option for gamblers who are looking for a safe and secure payment method.

The Best Practices for Online Security

Secure and Complex Passwords

As a rule, hard passwords should be set for different accounts. The use of password managers not only helps store and manage passwords but also protects against many security breaches.

Two-Step Verification

With two-step verification (2SV), the additional protection is that a second authentication method needs to be implemented such as the use of a temporary code sent to one’s phone which reduces the chances of unauthorized access even further.

Scam Reporting

Reporting scams to relevant authorities immediately, whether it be law enforcement or cybersecurity platforms, is important to help contribute to online safety. Scam perps are increasingly clever and it’s up to all of us to put a stop to it. By reporting online scams to your financial institution or law enforcement, as well as using national cybercrime reporting platforms, we can work together to fight back.

Having access to services such as the UK’s National Cyber Security Centre (NCSC) places you several steps ahead because they provide instantaneous information for known threats as well as recommended practices for dealing with cyber-attacks.

Conclusion

At the speed at which the internet is growing, it’s difficult to predict how it will develop in the future, with that being said it will always be important to stay cautious when browsing online.